- $25 Copay Before Deductible Mean

- Coinsurance Meaning

- Copay After Deductible Meaning On Mortgage

- Copay After Deductible Meaning Medical

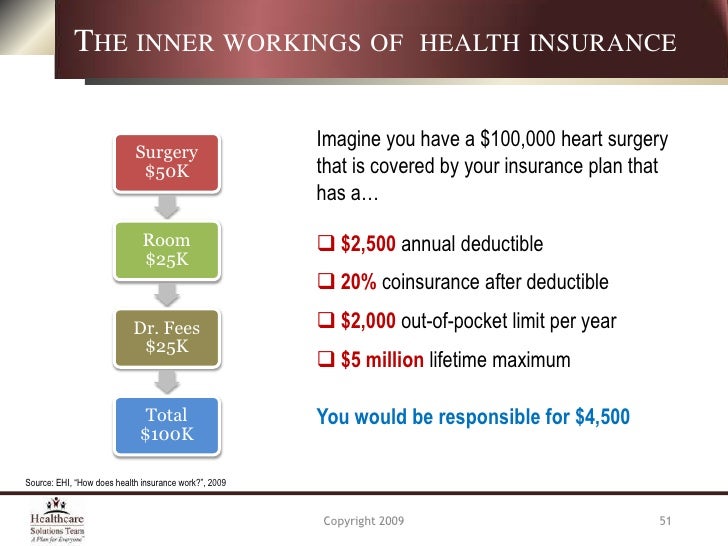

- Copayment A fixed amount ($20, for example) you pay for a covered health care service after you've paid your deductible. Let's say your health insurance plan's allowable cost for a doctor's office visit is $100. Your copayment for a doctor visit is $20.

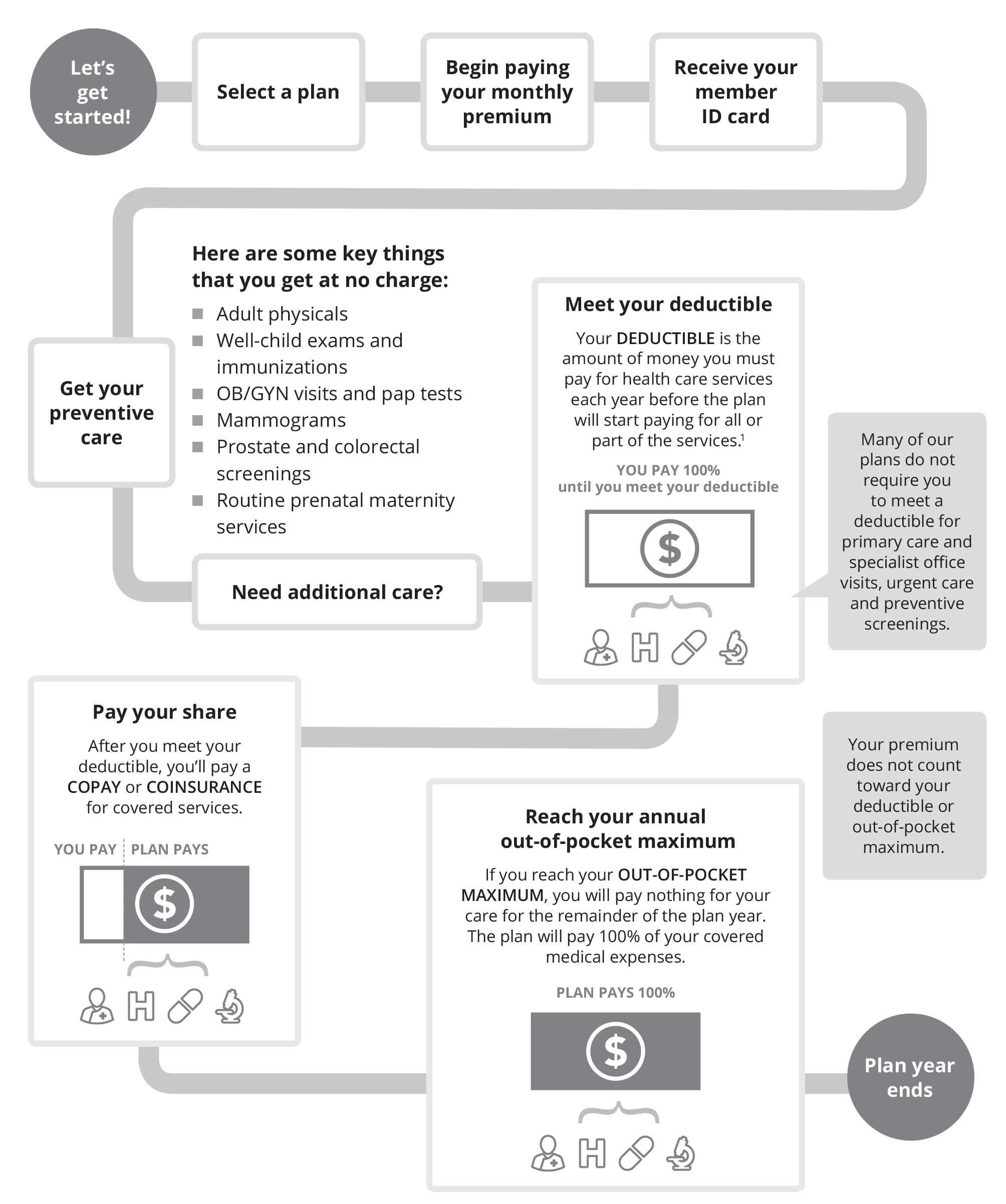

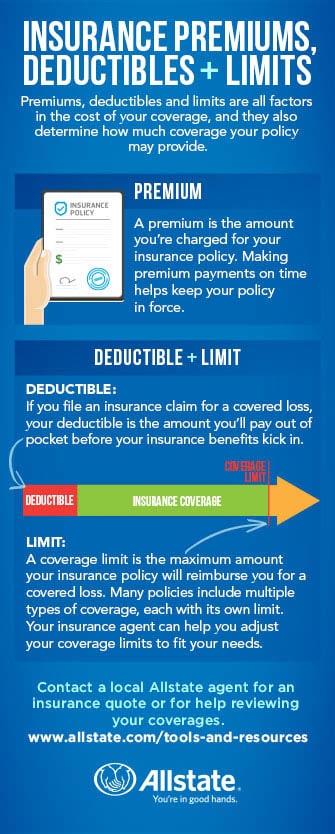

- A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service (at the pharmacy or doctor's office, for example).

$25 Copay Before Deductible Mean

4 thoughts on “ '$100 Copay before deductible/40% Coinsurance after deductible' ” user10543 November 30, -0001 at 12:00 am. Summary: The first ER trip is free (well, cheap). After that, ER trips start costing real money. (The language “before deductible,” though accurately transcribed, is misleading.). Pertaining to health insurance, what does 'Copay with deductible' mean, in contrast to 'Copay after deductible'? I get 'Copay after deductible' - you must pay for the service fully out of pocket until your deductible is met, after which you must only pay the copay amount and the insurance pays for the rest.

Coinsurance Meaning

Copay After Deductible Meaning On Mortgage

Copays for High Deductible Health Plans (HDHPs) work a little different from other types of plans. Typically with HDHPs, employees must meet their deductible before the carrier will pay for any services other than preventative care.

Copay After Deductible Meaning Medical

This means that if you have an HDHP with a $3,000 deductible and a $20 copay for primary care, you may have to meet the entire deductible before the copay will apply. This is why HDHPs are often paired with HSAs - the pretax contributions help offset the $3,000 deductible amount that you'll pay out-of-pocket before your copay can apply.